Our results also support recent recommendations of paying attention to individual sellers rather than entire DWMs40. Law enforcement agencies, however, have only recently started targeting individual sellers. The first operation took place in 2018 and successfully led to the arrest of 35 sellers41, while the largest operation to date occurred in 2020 and led to 179 arrests in six different countries42.

Multiseller Network

- Still, investigators have not ruled out the possibility of a hidden law enforcement operation.

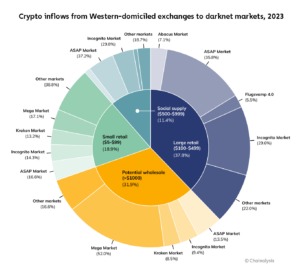

- As for drug markets serving Western customers, ASAP Market held a 25.0% share, followed by Mega and Incognito.

- More recently, Monero has become the cryptocurrency of choice for conducting illegal transactions in the Darknet.

- Abacus leans hard on its payment protection system, hitting a 98% success rate—one of the best we’ve tracked—keeping deals smooth between its 15,000+ users and 1,200+ sellers with few hiccups.

- These trends, sourced from platform data, user feedback, and darknet analytics, signal a maturing ecosystem where privacy, efficiency, and specialization are paramount.

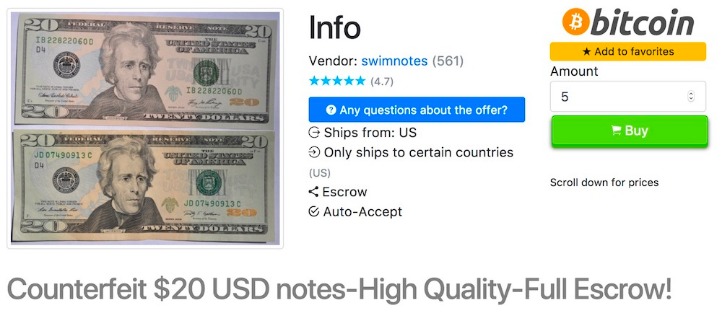

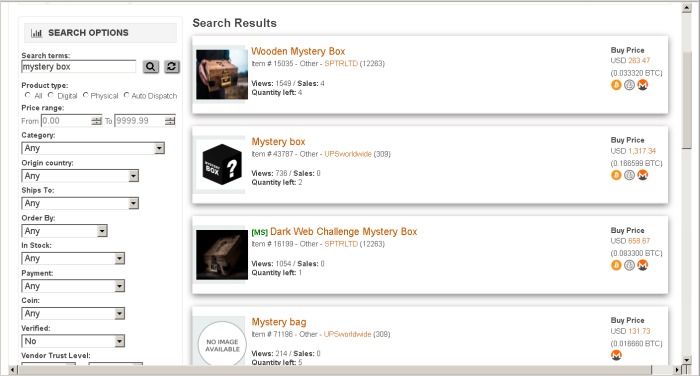

Some sellers offer cracked versions of expensive software that you’d typically pay hundreds of dollars for. Others sell pirated eBooks, academic materials, and entire premium courses ripped straight from paid platforms. It’s also a marketplace for digital mercenaries; you’ll find everything from solo hackers offering their skills to well-organized groups that take on more complex or high-stakes projects. Some even have connections to criminal organizations and, in more serious cases, government-backed operations.

Impact Of AI And Emerging Tech On Dark Web Operations

Ponzi schemes usually rely on new investors’ funds to pay earlier ones, collapsing once recruitment slows. Red flags include guaranteed high returns, lack of transparency, and unverifiable revenue sources.

The Continuing Battle For Darknet Market Dominance

XMR’s 40% adoption (e.g., Incognito) reflects this shift, though BTC’s speed suits fast trades on Bohemia. Trade only on markets with escrow—our top 10 average 94%+ success, reducing fraud by 25%. Verify escrow terms (e.g., Abacus’s 98% rate) and release funds only after delivery confirmation, avoiding direct deals that spike scam rates to 40% on non-escrow platforms. Use PGP (e.g., GPG or Kleopatra) to encrypt vendor messages—unencrypted comms risk interception by 10% of darknet actors in 2025. Generate a unique key pair, share your public key, and verify vendors’ keys via their profiles. They can be used as art, a way to share QR codes, ticketing and many more things.

Abacus Market Security

Nightmare market was a short-lived, moderately popular market that closed down in July 2019. Unlike other examples we’ve cited previously, Nightmare wasn’t shut down by law enforcement. They use pseudonymous wallets, privacy coins (like Monero), mixers, chain-hopping, and non-KYC platforms to obscure transaction trails. It has a bidding feature, with new batches of stolen data being frequently added. The Abacus Market links to the new dark web marketplace sections and took over much of the vacuum left by the AlphaBay takedown. Stick to cryptocurrency, avoid downloading anything, and don’t share any personal info.

XRP Slides 4% Amid Bitcoin Selloff, But Cup-And-Handle Setup To $5 Intact

After that quarter, their number remains small, which is represented by the dashed line. In all panels, the dashed vertical line marks the time of operation Bayonet. Chainalysis data shows darknet marketplace revenue dropped post-Hydra seizure in 2022 but recovered to $2 billion in Bitcoin inflows during 2024 Darknet market BTC inflow drop and shift to Monero. Abacus alone represented nearly 5 per cent of total DNM revenue, underscoring the ongoing scale of underground commerce. Fraud shops are services found mainly on the dark web that sell stolen data and personally identifiable information (PII), which cybercriminals use for scams, identity theft, and ransomware attacks. In 2024, fraud shop inflows declined by 50% YoY, a sharp downturn from the last three years.

Copy Trading Guide For Beginners (ANIMATED EXAMPLES)

The horizontal bars represent each market lifetime, i.e., the time when the market becomes active until its closure, and is colored according to the market’s monthly trading volume in USD. In the vertical axis, markets are in the chronological order of their launch date, although for some markets the activity effectively starts after the launch date (e.g., AlphaBay). The number of sellers in each category and multisellers as a function of time is shown in Fig. Until the end of 2013, when Silk Road is the dominant market (see Fig. 3), market-only sellers is the dominant category, and there are no multisellers. From the last quarter of 2013, U2U-only sellers become the largest category of sellers and remains as the largest throughout the rest of the observation period.

Specialized platforms like Vice City (80% drugs) thrive, offering depth over breadth, with 15% of 2025 trades in niche categories vs. 5% in 2022. Back then, the dark web was a niche curiosity for cyberpunks and tech rebels. Fast forward to 2025, and it’s a vast, digital underworld humming beneath our internet’s surface. While most of us browse websites with a few clicks, there’s an entire hidden ecosystem where anonymity reigns and commerce thrives, often illegally. The reduction in the quality and user numbers of Western DNMs stands in contrast to the Russian-language ecosystem, where fierce competition and high profits are driving innovation.

Crypto Markets Today: SOL Futures Are More Popular Than Ever, US Inflation Report Looms

Don’t concentrate funds—split trades across markets like Abacus and Vice City to mitigate risk. Supporting BTC (65%) and XMR (35%), Alphabay’s interface features multi-language support and real-time analytics (4.9/5 vendor score across 100,000+ reviews). Its history—$600M trades pre-2017 bust, relaunched in 2021, and 25% listing growth in 2025—shows resilience. Alphabay’s top-tier status stems from its scale, reliability, and advanced features, though peak-hour lag slightly tempers its rank. ASAP’s payment system scores a 94% success rate, clearing 90% of disputes in 36 hours—solid for its size.

Thus, further analyses in this direction have been hindered by the lack of heuristics able to identify these two key classes of actors in transaction networks and their roles in the structure and dynamics of the ecosystem. DWMs are also communication platforms, where users can meet and chat with other users either directly—using Whatsapp, phone, or email—or through specialised forums. We estimate that the trading volume of U2U pairs meeting on DWMs is increasing, reaching a peak in 2020 (during the COVID-19 pandemic). By contrast, trading volume on DWMs was negatively affected by COVID-19, mainly due to shipping delays37,38. The reasons for the differential impact of COVID-19 on U2U trading vs. DWM trading are difficult to pin down. One hypothesis is that U2U pairs managed to find better shipping logistics; another hypothesis is that they were seen as a safer way to trade than DWMs at a time of crisis.

Vice City Market Vendors

STYX market features a robust verification process, making it look more exclusive. The platform supports Monero (XMR), Bitcoin (BTC), and several others to hide identities. Perhaps, the figures can tell you what your personal information is worth when it lands on the dark web.

The absence of uniform global guidelines creates regulatory arbitrage, allowing entities to relocate to lenient jurisdictions. Many low- and middle-income countries, despite high crypto adoption, lack strong regulations, increasing their vulnerability to financial crimes. As digital finance evolves, striking a balance between innovation and security is crucial. Implementing AI-powered fraud detection, enhancing oversight, and promoting responsible adoption will help build a more transparent and resilient crypto ecosystem. Whereas, Pyramid schemes focus on recruitment rather than legitimate products, often disguised as crypto investments. With decentralized finance (DeFi) and social media amplifying scams, investors must remain vigilant against fraudulent schemes.